Running an ecommerce business is not for the faint of heart. You put effort into sourcing products, running ads, managing fulfillment, and optimising your website. But then comes an unexpected email: “Payment disputed.”

A chargeback is more than just a refund. It’s the reversal of a transaction initiated by the customer through their bank or card issuer. And for ecommerce businesses, chargebacks are one of the most frustrating realities of digital retail.

Why? Because they hit you twice: first by taking away the revenue, and second by adding penalty fees and damaging your payment processor relationship. In some cases, repeated chargebacks can even get your merchant account suspended.

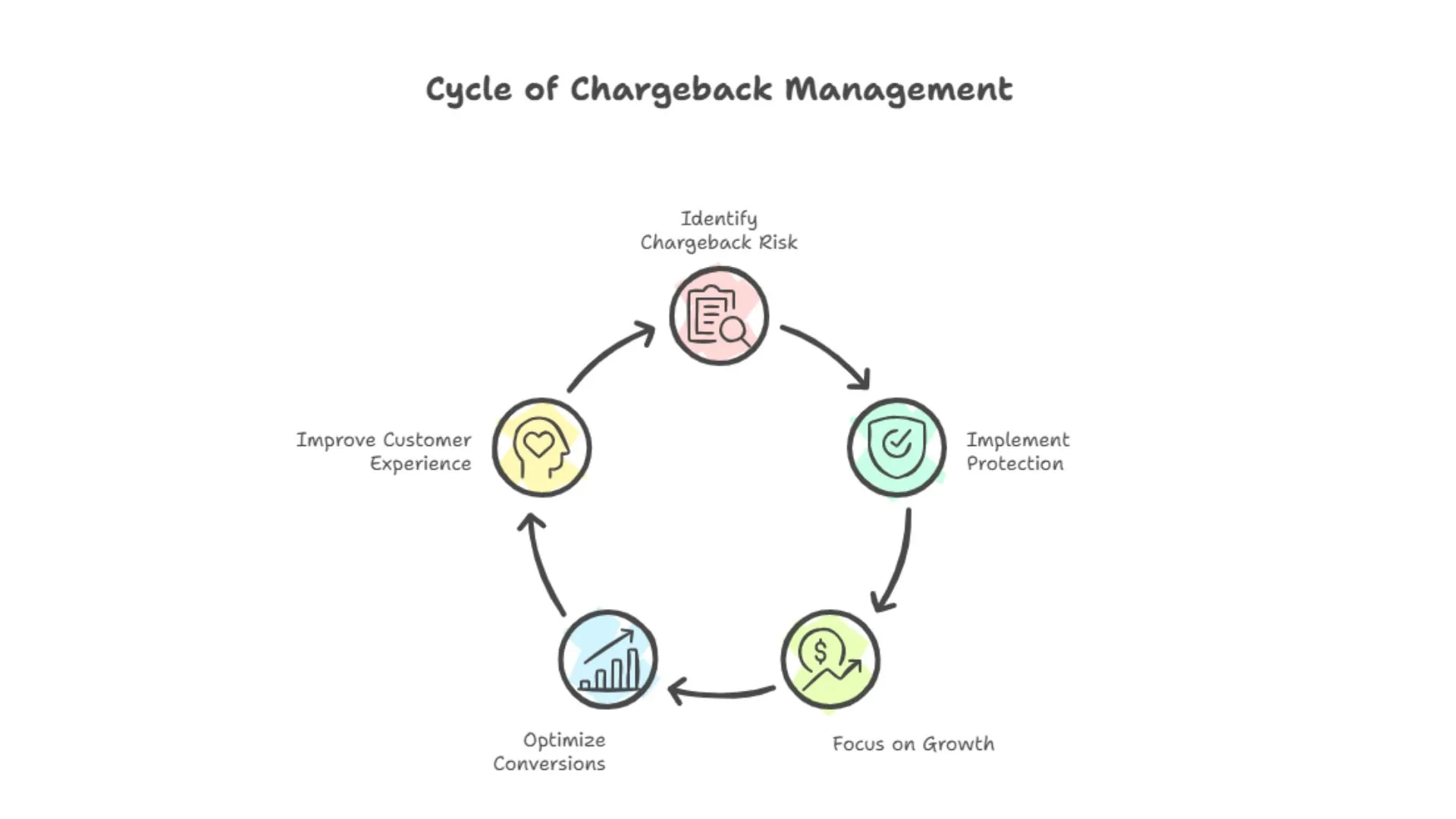

The good news? You don’t have to live in fear of them. This is where risk-free chargeback protection comes in. Instead of reacting to disputes after they happen, you can safeguard your D2C business against them and focus on what actually matters—growth, conversions, and customer experience.

This blog takes you through what chargeback protection really means, why it matters, how it links to conversion rate optimisation (CRO), and how pairing it with A/B Testing and website personalisation platforms like CustomFit.ai can give your ecommerce store a serious edge.

Chargebacks occur when a customer disputes a charge on their card. While refunds are initiated by you (the merchant), chargebacks are initiated by the bank.

The most common reasons include:

Every chargeback costs you not just the order value but also additional fees, often between $15–$100 per dispute. Worse, too many chargebacks can label your D2C business as “high risk,” which makes acquiring or maintaining payment processors harder.

It’s tempting to see a chargeback as just another refund. But in ecommerce, the impact runs deeper.

Studies suggest that for every $100 in chargebacks, the actual cost to a merchant is closer to $240 once hidden expenses are included.

For a growing ecommerce brand, this is a silent killer of margins.

Risk-free chargeback protection is a service where a third-party provider takes responsibility for disputes. If a fraudulent or invalid chargeback occurs, the provider covers the cost.

In other words:

This turns unpredictable chargebacks into a predictable, managed risk, giving your e-commerce business stability and peace of mind.

At first glance, chargeback protection may seem like a back-office function, while CRO (conversion rate optimization) and A/B Testing focus on the frontend. But they’re connected.

A customer who feels secure during checkout is more likely to complete a purchase. Knowing that their payment is protected reduces hesitation. For you, pairing chargeback protection with tools like CustomFit.ai’s A/B Testing Platform means you can experiment with checkout flows, payment options, and trust signals without worrying about disputes derailing your efforts.

For example:

When you combine CRO experiments with the safety net of chargeback protection, you increase conversion rate ecommerce while lowering costly disputes.

No more sudden revenue hits or unpredictable penalties.

Instead of wasting hours fighting disputes, you can run campaigns, optimise funnels, and explore new markets.

Handled properly, disputes can be turned into opportunities to rebuild trust. Chargeback protection ensures smoother resolution.

You don’t have to worry about frozen accounts or withheld funds.

With disputes managed, you can confidently run A/B tests on checkout pages, upsell offers, and payment methods—knowing you’re covered.

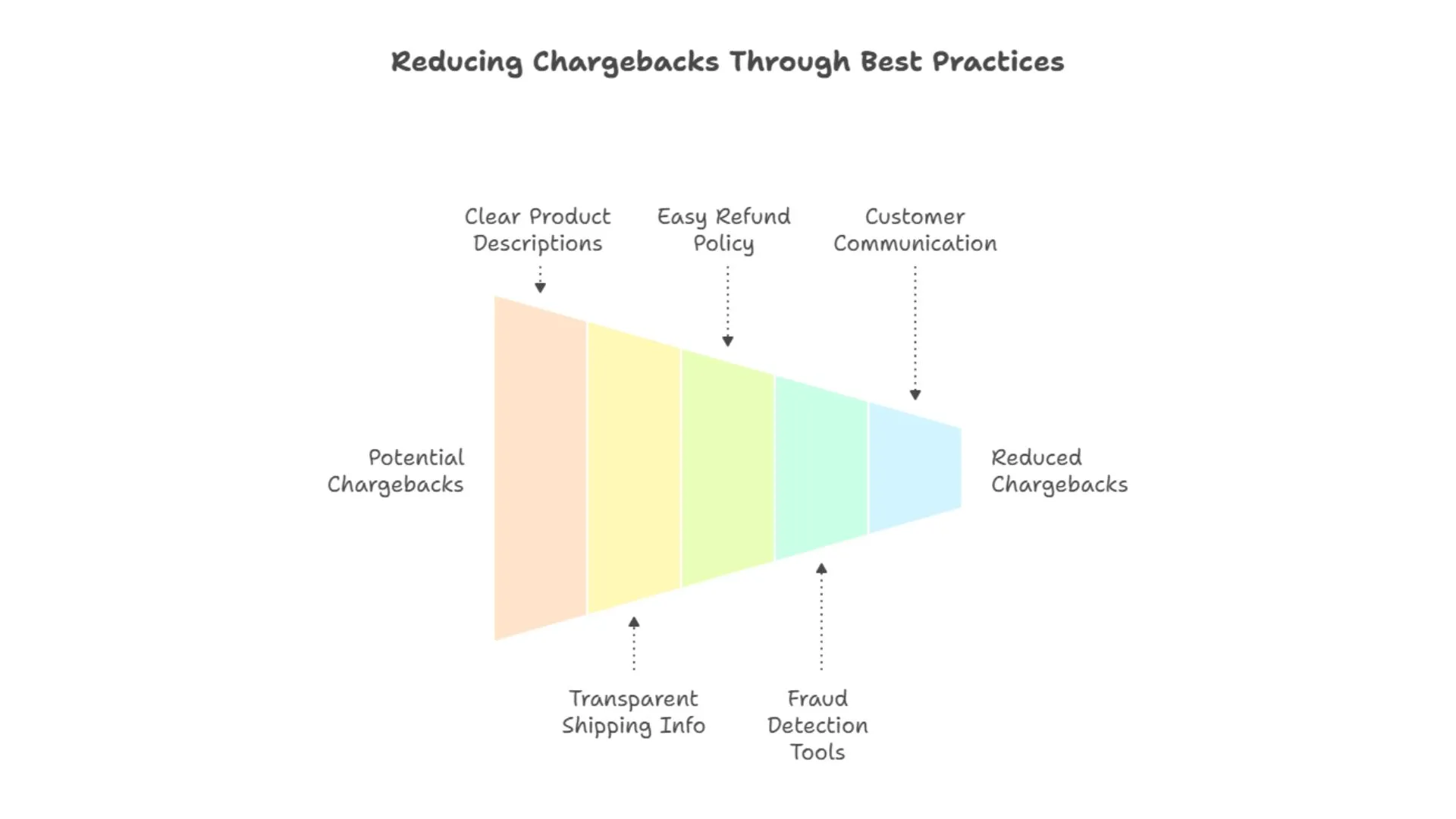

When paired with a risk-free chargeback solution, these practices lower your dispute rates even further, protecting your brand reputation and increasing conversion rates.

1. What is chargeback protection in ecommerce?

Chargeback protection is a service that shields merchants from financial losses caused by disputed transactions. The provider covers the costs of invalid chargebacks so the business doesn’t lose revenue.

2. How does risk-free chargeback protection help increase conversion rate ecommerce?

When customers feel secure about payments, they are more likely to complete purchases. For merchants, protection allows them to focus on CRO tactics like A/B Testing instead of fighting disputes.

3. Can chargeback protection replace A/B Testing?

No. Chargeback protection secures revenue, while an A/B Testing Platform like CustomFit.ai helps improve conversion rates through experimentation. Together, they create a stronger foundation for ecommerce growth.

4. Does chargeback protection cover all disputes?

Coverage depends on the provider. Some focus only on fraud-related disputes, while others cover non-fraud claims like “item not received.”

5. Is risk-free chargeback protection worth it for small ecommerce brands?

Yes. Small stores often feel the impact of chargebacks more severely. Protection gives them stability while they grow.

6. How does CustomFit.ai fit into this?

While chargeback protection prevents losses, CustomFit.ai helps merchants increase revenue by optimising websites through A/B Testing and personalisation. Using both ensures that ecommerce brands protect margins and increase conversion rates simultaneously.

7. Can I use chargeback protection on Shopify or WooCommerce?

Yes. Many providers integrate directly with major ecommerce platforms, making setup simple.

Ecommerce founders often juggle dozens of worries. Chargebacks shouldn’t be one of them. With risk-free chargeback protection, you can turn uncertainty into security and reclaim the time and energy to focus on what actually matters: growing your D2C business.

Pair that with continuous website optimisation through A/B Testing Platforms like CustomFit.ai, and you’re not just protecting revenue—you’re increasing it. By combining protection with experimentation, you safeguard your margins while actively working to improve them.

In a world where every click and checkout matters, giving your D2C business “zero worries” could be the most valuable gift you invest in this year.